Calculate computer depreciation tax

It doesnt disallow the write-off but it does limit it. C is the original purchase price or basis of an asset.

Different Methods Of Depreciation Calculation Sap Blogs

This depreciation calculator will determine the actual cash value of your Computers using a replacement value and a 4-year lifespan which equates to 004 annual depreciation.

. Depreciable amount Units Produced This Year Expected. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. R i is the.

Where D i is the depreciation in year i. Calculate the depreciation amounts for. Under the depreciation formula this converts to a Diminishing Value percentage rate of 50 per annum or Prime Cost 25.

This depreciation calculator is for calculating the depreciation schedule of an asset. The Platform That Drives Efficiencies. MobilePortable Computers including laptops and.

For example the first-year. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence. The MACRS Depreciation Calculator uses the following basic formula.

Base value days held see note. The formula to calculate annual depreciation through straight-line method is. It provides a couple different methods of depreciation.

To work out the decline in value of his desktop computer Colin elects to calculate the decline in value of his computer using the diminishing value method. Depreciated for the regular tax using the 200 declining balance method generally 3 5 7 or 10 year property under the modified accelerated cost recovery system MACRS. D i C R i.

Lets say on average you spend four hours working and six hours on Netflix every day no judgement. First one can choose the straight line method of. The calculation methods used include.

Asset-based depreciation calculate your share of deprecating assets in a. Your small business pool. Expertly Manage the Largest Expenditure on the Balance Sheet with Efficiency Confidence.

The most common depreciation is called straight-line depreciation taking the same amount of depreciation in each year of the assets useful life. The Platform That Drives Efficiencies. In that case your.

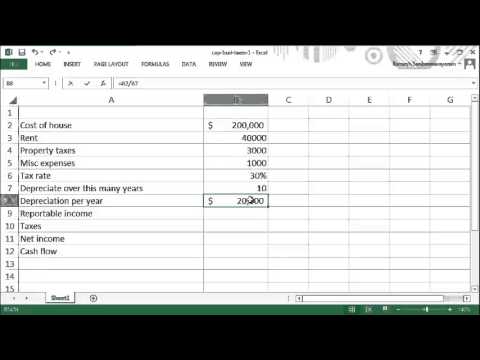

This Excel worksheet will calculate standard depreciation using various methods each with its own benefits and drawbacks. Cost Scrap Value Useful Life. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating.

How To Calculate Depreciation Expense For Business

Depreciation Rate Formula Examples How To Calculate

Using Spreadsheets For Finance How To Calculate Depreciation

How To Calculate Depreciation Expense

Depreciation What Is Depreciation Depreciation Definition Formula

How To Save Money With A Small Business Tax Deductions Checklist 2021 Insureon

Depreciation Rate Formula Examples How To Calculate

Macrs Depreciation Calculator Straight Line Double Declining

Depreciation Rates For Ay 2020 21 New Rates Section 32 Of Income Tax

Depreciation Formula Calculate Depreciation Expense

Asset Depreciation Getting The Most Back On Your Tax Return

11 Tax Credits And Exemptions Every Business Owner Should Know About

How To Calculate Depreciation As Per Companies Act 2013 Depreciation Chart As Per Companies Act Youtube

Compute Cash Flow After Depreciation And Tax Youtube

Depreciation Calculator Depreciation Of An Asset Car Property

How To Calculate Depreciation

How To Calculate Depreciation On Computer Hardware A Cheat Sheet Techrepublic